3dcooper.ru

News

I Would Like To Refinance My Car

Refinancing your car means replacing your current auto loan with a new one. The new loan pays off your original loan, and you begin making monthly payments on. Why Should I Refinance My Car Loan? · Reduce your interest rate – Interest rates change regularly, so there's a good chance that they've fallen since you first. Yes, you can refinance a car. The process involves shopping around for a new loan with better terms or rates, applying for the new loan, and. Refinancing opens the door to a shorter loan term so you can pay off your car faster and cruise into financial freedom. Lower my APR: Pre-qualifying to. Getting your auto loan refinanced can get you lower rates and payments in the long run if you have a better credit score or if car loan rates drop. However. Is an auto refinance right for you? Looking for a lower interest rate? Want to pay off your loan sooner? Refinancing may be a good choice. Refinancing is only beneficial when your new auto loan is somehow superior to the old one. So, it may make sense to refinance if something has happened that. So, if you're in the midst of applying for a mortgage loan, you may want to wait a while before refinancing your car — or you could do both through the same. Refinancing your vehicle with Ally could help lower your monthly payment. Find out in minutes if you pre-qualify with no impact to your credit score. Refinancing your car means replacing your current auto loan with a new one. The new loan pays off your original loan, and you begin making monthly payments on. Why Should I Refinance My Car Loan? · Reduce your interest rate – Interest rates change regularly, so there's a good chance that they've fallen since you first. Yes, you can refinance a car. The process involves shopping around for a new loan with better terms or rates, applying for the new loan, and. Refinancing opens the door to a shorter loan term so you can pay off your car faster and cruise into financial freedom. Lower my APR: Pre-qualifying to. Getting your auto loan refinanced can get you lower rates and payments in the long run if you have a better credit score or if car loan rates drop. However. Is an auto refinance right for you? Looking for a lower interest rate? Want to pay off your loan sooner? Refinancing may be a good choice. Refinancing is only beneficial when your new auto loan is somehow superior to the old one. So, it may make sense to refinance if something has happened that. So, if you're in the midst of applying for a mortgage loan, you may want to wait a while before refinancing your car — or you could do both through the same. Refinancing your vehicle with Ally could help lower your monthly payment. Find out in minutes if you pre-qualify with no impact to your credit score.

When Should I Refinance My Car? You can refinance your auto loan anytime. The sooner you refinance, the more money you'll save. That being said, if you need. You want to change the loan term It also makes sense to refinance your car loan if your financial situation has changed. Perhaps you lost your job and need a. Although your refinanced monthly payment may be lower, you should carefully consider the amount of any costs associated with refinancing such as any state taxes. If you're unhappy with your car loan and wondering if there's potential to lower your monthly loan payment, you might want to consider refinancing. Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. To qualify, your car must be: Upgrade auto refinancing currently not available for RVs, motorcycles, commercial vehicles, or salvaged vehicles. And your. Refinancing: Refinancing at a longer repayment term may lower your car payment, but may also increase the total interest paid over the life of the loan. You could save with auto refinancing · Get a personalized rate in minutes. · Enjoy an easy online process. · Checking your rate won't affect your credit score.¹. If you want to change your loan term, or if you think you can get a better Annual Percentage Rate (APR) than before, refinancing might make sense for you. Read. the next business day. How much could my auto loan payments be? Estimate your monthly payment. New or Used? New. Used. How much would you like to finance? Refinancing your car loan starts with checking your rate. Then you'll confirm details about you, your vehicle, and your current car loan. Once your new loan. If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. If it's the same or. When should you refinance your car? · Your current interest rate is high. When you first bought your car, you may not have qualified for the best rate. · You want. Get pre-qualified for an auto refinance loan instantly with just a few questions. You'll immediately see what rate you may be eligible for, without a hit to. Love your car, but not your current auto loan? Depending on your current loan terms, refinancing could change the duration of your loan, lower your interest. Paying off your existing car loan and refinancing it into a new one could help you save money by scoring a lower interest rate. Apply today. Auto loan refinancing by iLending, the nations leader to refinance a car loan. Average savings $/month* with iLending auto loan refinance. This will roll your auto loan over to us, allowing you to lock in one of our competitive rates and make your payments to PSECU instead of the lender you'd like. If the lender is the same, they'll retire your old loan and issue a new loan that you'll start making payments on instead. If you are thinking of trading in. Get pre-qualified for an auto refinance loan instantly with just a few questions. You'll immediately see what rate you may be eligible for, without a hit to.

How To Pay Credit Card Bill To Build Credit Score

Tip: One way to build credit while keeping your balance under control is to charge a small, recurring transaction to your credit card, like a monthly streaming. You might not have to apply for a secured credit card to start building credit. Several “starter” cards are available that let you build your credit history. 1. Pay on time, every time (35% of your FICO Score) · 2. Keep your credit utilization low (30% of your FICO Score) · 3. Limit new credit applications (15% of your. Paying down balances on credit cards is one of the fastest ways to improve your credit score, Griffin says. Make all of your payments on time. Because payment. The key is choosing a credit card that fits your goals and credit profile. And from there, create an on-time usage and payment history to establish and. Paying off your credit card debt each month is one of the most consistent ways to help improve your credit scores. But when in the month is the best time to pay. 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types of Credit You Have · 5. Limit New. Pay bills on time. Sounds simple, and easier said than done, but it's the best way to start getting your payment history back on track. · Get/stay current on. Paying your balance more than once per month makes it more likely that you'll have a lower credit utilization rate when the bureaus receive your information. Tip: One way to build credit while keeping your balance under control is to charge a small, recurring transaction to your credit card, like a monthly streaming. You might not have to apply for a secured credit card to start building credit. Several “starter” cards are available that let you build your credit history. 1. Pay on time, every time (35% of your FICO Score) · 2. Keep your credit utilization low (30% of your FICO Score) · 3. Limit new credit applications (15% of your. Paying down balances on credit cards is one of the fastest ways to improve your credit score, Griffin says. Make all of your payments on time. Because payment. The key is choosing a credit card that fits your goals and credit profile. And from there, create an on-time usage and payment history to establish and. Paying off your credit card debt each month is one of the most consistent ways to help improve your credit scores. But when in the month is the best time to pay. 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types of Credit You Have · 5. Limit New. Pay bills on time. Sounds simple, and easier said than done, but it's the best way to start getting your payment history back on track. · Get/stay current on. Paying your balance more than once per month makes it more likely that you'll have a lower credit utilization rate when the bureaus receive your information.

Paying more than the minimum each month will help keep your credit utilization ratio lower. Credit cards report your payment history to credit bureaus, which. Having credit cards and using them isn't a bad thing, but it's important to keep your debt manageable. The best practice is to pay your credit card bills in. pay yourself back with a statement credit towards travel and dining purchases When handled responsibly, a credit card can help you build your credit history. If you find the right secured credit card and consistently pay your bill on time, your credit score will grow. So, which is the 'right' secured card? It's one. You should pay your credit card bill by the due date as a general rule, but in some cases you could actually benefit from paying it sooner. Use payment reminders through your banks' online portals if they offer the option. Consider enrolling in automatic payments through your credit card and loan. Some credit cards let you transfer the balance from another card. Transferring a debt from a card with a high rate of interest to one with low or 0% interest. Your credit utilization ratio is only one factor that makes up your credit score, and making multiple payments each month is unlikely to make a big difference. Pay down your cards: If you have several credit cards, and they're all maxed out, it's time to pay them down. The most effective way is the “debt avalanche,” in. Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit. · Many credit cards put. 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute credit report errors. Get a Handle on Bill Payments As you can see, payment history has the biggest impact on your credit score. That is why, for example, it's better to have paid-. So use your credit card to make purchases, but don't go over your credit limit or let your balance owed get too high to manage. Pay at least the minimum payment. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. Pay Your Credit Card Bill Every Month Paying your bill each month helps build a track record of repaying your debt consistently. You can pay the full balance. The most important factor of your credit score is your payment history. That's why paying your credit card bill on time consistently is the best way to build. Nothing helps your credit score more than your ability to make payments on time. If you can pay off your credit card balance in full each month, that helps. The most important factor of your credit score is your payment history. That's why paying your credit card bill on time consistently is the best way to build. Yes. Your credit rating is based on your debt to credit. By charging high and paying it off every month, you will be offered higher limits. By showing lenders that you're a responsible borrower, you may be able to boost your credit score and eventually, can take on other lines of credit. What is a.

Metal Visa Card Crypto

Metal Card 3dcooper.ru · Keep browsing similar items · Satoshi Express Bitcoin Silver Card Metal Credit Card Swap, Chip and Magnetic Strip Migration, Safe & Secure. High-quality premium metal cards. Card Type Visa Debit (pre-paid). Cryptocurrencies Supported 20+. Rewards Up to 5% cryptoback. Pros & Cons. Pros. Available at. The top provider worldwide of metal payment cards, CompoSecure, will supply Visa prepaid cards with metal fronts and polymer backs to 3dcooper.ru Exclusive Aluminium & Stainless Steel metal cards available for Chairman and VIP membership; Daily card load limit $15,; Top up your card from your bank. Cryptodraft: Allows you to get extra funds to spend on the card without selling crypto! You can access a line of stablecoin credit, while using crypto as. The Gemini Credit Card by WebBank operates on the Mastercard network to instantly reward every purchase with cryptocurrency through black, silver, or rose gold. No annual fee*. Plus, no foreign transaction fees* and no exchange fees to acquire your crypto rewards. · Instant rewards the moment you swipe³ · Rewards with the. Note: 3dcooper.ru Card is a VISA debit card. Some traders may need a credit card transaction to access and use their services. Some subscription-based services. US users can earn unlimited crypto rewards from everyday spending. Enjoy zero spending fees and no annual fees. Cards accepted at 40M+ merchants worldwide. Metal Card 3dcooper.ru · Keep browsing similar items · Satoshi Express Bitcoin Silver Card Metal Credit Card Swap, Chip and Magnetic Strip Migration, Safe & Secure. High-quality premium metal cards. Card Type Visa Debit (pre-paid). Cryptocurrencies Supported 20+. Rewards Up to 5% cryptoback. Pros & Cons. Pros. Available at. The top provider worldwide of metal payment cards, CompoSecure, will supply Visa prepaid cards with metal fronts and polymer backs to 3dcooper.ru Exclusive Aluminium & Stainless Steel metal cards available for Chairman and VIP membership; Daily card load limit $15,; Top up your card from your bank. Cryptodraft: Allows you to get extra funds to spend on the card without selling crypto! You can access a line of stablecoin credit, while using crypto as. The Gemini Credit Card by WebBank operates on the Mastercard network to instantly reward every purchase with cryptocurrency through black, silver, or rose gold. No annual fee*. Plus, no foreign transaction fees* and no exchange fees to acquire your crypto rewards. · Instant rewards the moment you swipe³ · Rewards with the. Note: 3dcooper.ru Card is a VISA debit card. Some traders may need a credit card transaction to access and use their services. Some subscription-based services. US users can earn unlimited crypto rewards from everyday spending. Enjoy zero spending fees and no annual fees. Cards accepted at 40M+ merchants worldwide.

Holyheld is a onchain crypto debit card. The one card for all crypto natives. Get your card, pay from your phone, use your wallet, and pick your crypto. Users can use its metal prepaid Visa card to get up to 8% cash back when they use its Visa-supported card to spend cryptocurrency. Aside from using crypto. Unlimited Cards. Basic. $ Minimum Credit Limit. $0. Monthly No Fee ATM Withdraws. Metal Cards. Credit Card Benefits *. McAfee. ID Theft Protection. Zero. USD or crypto – the choice is yours with our Visa Debit card. Simply select USD or what crypto you'd like to spend in your spend wallet on our mobile app and. In the late s, they were modified to enable commerce on the internet (e-commerce). Design Review of Metal Crypto Cards in The Club Swan HODL. A unique N26 Metal debit card N26 Metal's Mastercard debit is crafted in grams of stainless steel, and is available in three distinct metallic shades. One Credit Card is India's best and smartest metal credit card. Apply credit card online & get instant approval. Enjoy benefits like 5X reward points. Polished Metal. Diamond Encrusted Metal. -. -. NFT Customization. NFT Best rate guaranteed Room upgrade Breakfast Late checkout USD Hotel Credit. If available, authorized users may upgrade to a stainless steel card for a fee. See Robinhood Credit Card App for details. Crypto · Retirement · Options. Exclusive Aluminium & Stainless Steel metal cards available for Chairman and VIP membership; Daily card load limit $15,; Top up your card from your bank. 5. Card Balance / Top-up. At any point in time, you can only have SGD on your metal VISA card. The total amount that you can spend with this card cannot. Crypto Trader. CAD $ CAD $ Note: The VISA logo will be replaced with your card logo (eg. Mastercard). Additional Instructions (we'll try to accomodate. How does it work? Purchase your preferred Apple gear with your Crypto․com Visa Card and receive a % rebate depending on your card tier. CompoSecure designs and manufacturers high-end metal payment cards & secure authentication solution for banks, fintechs, and other businesses around the. The CoinZoom® Crypto Visa Debit card allows you to spend your USD or crypto at over 53 million merchants worldwide while earning up to 5% back in ZOOM. Which Metal VISA debit card is right for you? Up to 8% cashbacks, airport lounge access with free Spotify, Netflix, Amazon Prime and Airbnb. A unique N26 Metal debit card N26 Metal's Mastercard debit is crafted in grams of stainless steel, and is available in three distinct metallic shades. CompoSecure designs and manufacturers high-end metal payment cards & secure authentication solution for banks, fintechs, and other businesses around the. Thales Gemalto Metal Card Portfolio · Thales Gemalto Innovative Cards · Stay ahead of the Curve · 3dcooper.ru's Visa Card stands out from the crowd with metal · The. If I apply, will I get a metal card? If you do not choose a cryptocurrency you will earn rewards in Bitcoin, which is the default cryptocurrency for the.

What Age Can You Get A Real Estate License

Step 1: Must be at least 18 years of age Before you apply for a license, you can request that the Commission determine whether your fitness meets TREC's. To become a real estate agent in Florida, you must meet several requirements, including Real Estate Associate Requirements, Real Estate Broker Requirements. To get a New York real estate license, you need to be at least 18 years of age. There is no requirement to have a GED or high school diploma in order to get. Step 1: Meet the Requirements. Must be at least 18 years of age. Applicants may take the salesperson's examination at age 17, but cannot activate the license. Must be at least 18 years old; Must complete 77 hours of real estate coursework through an approved provider if you completed your education outside of NY state. You must be at least 18 years old to get started. You must be a U.S. citizen or a lawfully admitted alien. Pass a Background Check. TREC requires you to get. Is there an age requirement to become a licensed Real Estate. Broker? Yes. Real Estate Broker applicants must be 20 years of age or older. You don't have to be a Florida resident to apply and obtain your real estate license. Submit your application online or using a printable form to the Florida. Be at least eighteen (18) years of age. · Have a Social Security Number or Federal ID number. Step 1: Must be at least 18 years of age Before you apply for a license, you can request that the Commission determine whether your fitness meets TREC's. To become a real estate agent in Florida, you must meet several requirements, including Real Estate Associate Requirements, Real Estate Broker Requirements. To get a New York real estate license, you need to be at least 18 years of age. There is no requirement to have a GED or high school diploma in order to get. Step 1: Meet the Requirements. Must be at least 18 years of age. Applicants may take the salesperson's examination at age 17, but cannot activate the license. Must be at least 18 years old; Must complete 77 hours of real estate coursework through an approved provider if you completed your education outside of NY state. You must be at least 18 years old to get started. You must be a U.S. citizen or a lawfully admitted alien. Pass a Background Check. TREC requires you to get. Is there an age requirement to become a licensed Real Estate. Broker? Yes. Real Estate Broker applicants must be 20 years of age or older. You don't have to be a Florida resident to apply and obtain your real estate license. Submit your application online or using a printable form to the Florida. Be at least eighteen (18) years of age. · Have a Social Security Number or Federal ID number.

You are at least 18 years of age. · You have a high school diploma or equivalent. · You have NOT been convicted of certain felonies within a specific timeframe. The second is that you must have completed high school or an equivalent degree. So, before you can proceed with any other requirements, ensure that you: Are 1. Meet the requirements · Be at least 18 years old. · Have a high school diploma or equivalent. · Complete 90 hours of approved real estate education including a. -You must be at least 18 years old in order to become licensed in Georgia. (If you are 17, you may sit for the exam, however, the license cannot be activated. In New York, individuals must be at least 18 years old to apply for a real estate license. It's important to note that age requirements can vary from state to. Prospective salespersons should be aware that New York requires individuals to be at least 18 years old to qualify for a real estate salesperson license. At. Be at least 18 years of age. Actively engaged as a real estate salesperson in CT for at least 3 years. hour classroom course in Real Estate Principles and. Have reached the age of majority, eighteen (18). Successfully complete sixty (60) classroom hours of real estate education of which thirty (30) classroom hours. Be at least 18 years of age; Be a resident of Vermont; Complete 40 hours of approved Vermont Pre-Licensing education; Pass the course final exam; Take and pass. Be at least 18 years of age at the time of application and provide a valid social security number. At a minimum, have a High School diploma or its equivalent. To start: You must be at least 18 years of age. Quick Facts: What is the average NY real estate agent salary? Be at least eighteen (18) years of age. Be of good character and reputation. Step 2. Complete an approved 60 hours of Maryland real estate pre-license education. Typically you are required to complete a study course before you can take the state license exam. Also check your local Community College for. Be 18 years of age; · Have attained a high school diploma or GED; · Completed all real estate pre-license courses prior to taking the real estate examination;. General Requirements. Age: You must be 18 years of age or older to be issued a license. Residence: If you are not a California resident. How to Get a License · PSI Examination Application- obtained upon completion at testing center (application must be signed by Principal Broker) · Proof of High. You can also take the State real estate salespersons exam at age 17; however, you cannot activate your license until you are at least 18 years old. How can I. Meeting minimum age requirements (18 for agents and 21 for brokers); Completing specific real estate coursework; Passing an exam (or two, depending on the. The minimum age requirement for obtaining a real estate license in Michigan is 18 years old. This means that if you are 17 years old, you cannot yet apply for. Additionally, an applicant must complete 75 hours (5 credits) of basic real estate courses from an accredited college or an approved real estate education.

Capital Gains From Real Estate

Capital Gains Tax Rates for 20; Single, Up to $44,, $44, to $,, Over $, ; Head of household, Up to $59,, $59, to $, For commercial real estate investors, understanding the impact of capital gains taxes — and how to minimize that impact — is essential to maximizing. A capital gains tax is a type of tax on the profit obtained when an asset, such as real estate property, has increased in value and is sold. This tax is only. Real Estate Capital Gains Calculator · Net adjusted basis · Capital gain · Depreciation recapture (25%) · Federal capital gains tax · State capital gains tax · Total. In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $, (or up to $, for married. A Special Real Estate Exemption for Capital Gains. Since , up to $, in capital gains ($, for a married couple) on the sale of a home is exempt. Capital gains tax is a tax levied on possessions and property—including your home—that you sell for a profit. On a sale, any gain will be a capital gain. However, a property which is purchased on speculation (an adventure in the nature of trade) will result in the gain. Capital gain calculation in four steps · Determine your basis. · Determine your realized amount. · Subtract your basis (what you paid) from the realized amount . Capital Gains Tax Rates for 20; Single, Up to $44,, $44, to $,, Over $, ; Head of household, Up to $59,, $59, to $, For commercial real estate investors, understanding the impact of capital gains taxes — and how to minimize that impact — is essential to maximizing. A capital gains tax is a type of tax on the profit obtained when an asset, such as real estate property, has increased in value and is sold. This tax is only. Real Estate Capital Gains Calculator · Net adjusted basis · Capital gain · Depreciation recapture (25%) · Federal capital gains tax · State capital gains tax · Total. In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $, (or up to $, for married. A Special Real Estate Exemption for Capital Gains. Since , up to $, in capital gains ($, for a married couple) on the sale of a home is exempt. Capital gains tax is a tax levied on possessions and property—including your home—that you sell for a profit. On a sale, any gain will be a capital gain. However, a property which is purchased on speculation (an adventure in the nature of trade) will result in the gain. Capital gain calculation in four steps · Determine your basis. · Determine your realized amount. · Subtract your basis (what you paid) from the realized amount .

Previously, the capital gains inclusion rate for secondary properties (cottages, vacation homes, investment properties) was 50%. This meant that only half of. Property owners can exclude up to $, in capital gains from the sale of their primary residence if the filing status is single, and up to $, in. Capital gains tax applies when you sell any kind of capital asset for a profit, also known as a capital gain. This could be an investment, or a car, or real. In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $, (or up to $, for married. Estimate real estate capital gains taxes for selling a condo, co-op or house in NYC. Federal, state and city capital gains tax calculator for New York City. Do I owe capital gains tax when I sell real estate? No. Washington's capital gains tax does not apply to the sale or exchange of real estate. It does not. Capital gains taxes apply whether you earn a profit buying and selling stocks, collectibles, or anything else of value — including real estate. There's an exclusion on gains from the sale of a primary residence, which generally lets sellers exclude up to $, in gains from their income (or $, Keep in mind that if you earn over $, as a married couple or $, as an individual, including your real estate sale gains, you are subject to an. Learn more about capital gains tax on real estate with advice from the tax experts at H&R Block. Learn how to avoid capital gains taxes on real estate, including what exemptions you might already be eligible to receive. Nonresident foreign nationals are generally exempt from US taxes on capital gains (although they may pay taxes abroad), there is a notable exception for real. For individuals, a hike in the inclusion rate from 50% to % for capital gains above $, each year. Importantly, owners selling their businesses will. In this article, we'll explain how taxes on capital gains work, and how to avoid paying capital gains tax on rental property. Having an investment property complicates the calculation of the capital gains amount due to rental income real estate taxation rules. You may also have to. In real estate, capital gains are based not on what you paid for the home, but on its adjusted cost basis. To calculate, follow these steps. Capital gains tax is payable on the net gain from the sale of property. The gain is calculated by taking the sale price less the purchase price and all. After all, up to $, of the profit earned when selling real estate with a spouse is tax-free, or $, if a single person sells. Nevertheless, $, Sell your property when your income is the lowest Timing is everything, especially when it comes to real estate and capital gains tax. Since the amount of. A special real estate exemption for capital gains. Since , up to $, in capital gains ($, for a married couple) on the sale of a home is exempt.

How Much Are Mexican Pesos Worth

/168317996-56a3ea483df78cf7727fdc5f.jpg)

Latest Currency Exchange Rates: 1 Mexican Peso = US Dollar · Currency Converter · Exchange Rate History For Converting Mexican Pesos (MXN) to Dollars (USD). Convert 10 Mexican pesos MXN to US dollars USD. Use Alpari's converter to quickly and conveniently make currency conversions online. 1 USD = MXN Sep 03, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy. This Free Currency Exchange Rates Calculator helps you convert Mexican Peso to US Dollar from any amount. Historical Exchange Rates For United States Dollar to Mexican Peso · Quick Conversions from United States Dollar to Mexican Peso: 1 USD = MXN. 1 Mexican Peso = US Dollars as of September 3, PM UTC. You can get live exchange rates between Mexican Pesos and US Dollars using exchange-. 1 MXN = USD Sep 03, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. The “old pesos” have been demonetized. Even if they were still able to be exchanged? The new peso is worth 5 USA cents. old pesos to one new peso Mexican Pesos to US Dollars conversion rates ; 1 MXN, USD ; 5 MXN, USD ; 10 MXN, USD ; 25 MXN, USD. Latest Currency Exchange Rates: 1 Mexican Peso = US Dollar · Currency Converter · Exchange Rate History For Converting Mexican Pesos (MXN) to Dollars (USD). Convert 10 Mexican pesos MXN to US dollars USD. Use Alpari's converter to quickly and conveniently make currency conversions online. 1 USD = MXN Sep 03, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy. This Free Currency Exchange Rates Calculator helps you convert Mexican Peso to US Dollar from any amount. Historical Exchange Rates For United States Dollar to Mexican Peso · Quick Conversions from United States Dollar to Mexican Peso: 1 USD = MXN. 1 Mexican Peso = US Dollars as of September 3, PM UTC. You can get live exchange rates between Mexican Pesos and US Dollars using exchange-. 1 MXN = USD Sep 03, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. The “old pesos” have been demonetized. Even if they were still able to be exchanged? The new peso is worth 5 USA cents. old pesos to one new peso Mexican Pesos to US Dollars conversion rates ; 1 MXN, USD ; 5 MXN, USD ; 10 MXN, USD ; 25 MXN, USD.

Convert Mexican Peso to US Dollar ; 1 MXN, USD ; 5 MXN, USD ; 10 MXN, USD ; 25 MXN, USD.

USD to MXN Today | US Dollars to Mexican Pesos Exchange Rates ; Remitly Exchange Rate. Reviews. First Time User Rate. Mex$ · $ ; Wise Exchange Rate. Comparison table of one Dollar exchange rate to Mexican Pesos published today by banks and the Mexican government entities. Entity, Dollars, Pesos, Buy, Sell. Mexican Peso ; Open $ ; Day Range - ; 52 Week Range - ; 5 Day. % ; 1 Month. %. Indicate how many 1 Mexican Peso coins you want to exchange; Click on the 'Add to Wallet' button; The exchange value has been added to your online wallet. Download Our Currency Converter App ; 1 MXN, USD ; 5 MXN, USD ; 10 MXN, USD ; 20 MXN, USD. Latest Currency Exchange Rates: 1 US Dollar = Mexican Peso · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Mexican Pesos (MXN). USD to MXN | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Mexican Peso. Calculator to convert money in Mexican Peso (MXN) to and from United States Dollar (USD) using up to date exchange rates. In , the value of the golden peso was reduced by percent, but the silver peso remained unchanged. After the oil crisis in , Mexico experienced many. 1 Mexican Peso = US Dollars as of September 3, PM UTC. You can get live exchange rates between Mexican Pesos and US Dollars using exchange-. Q: What is the Dollar worth against the Mexican Peso? A: One Dollar is worth Mexican Pesos today. Q: Is the Dollar going up or down against the. US Dollars to Mexican Pesos conversion rates ; 1 USD, MXN ; 5 USD, MXN ; 10 USD, MXN ; 25 USD, MXN. Mexican peso to US dollars exchange rate history. The exchange rate for Mexican peso to US dollars is currently today, reflecting a % change since. Get US Dollar/Mexican Peso FX Spot Rate (MXN=:Exchange) real-time stock quotes, news, price and financial information from CNBC. One MXN is equivalent to MXP. Mexican Peso (MXN) and United States Dollar (USD) Click on United States Dollars or Old Mexican Pesos to convert between. Mexican Peso - values The USDMXN spot exchange rate specifies how much one currency, the USD, is currently worth in terms of the other, the MXN. The 20 centavos coin has the same value as $ Mexican Pesos. You get: £ 1 MXN = £. US Dollar to Mexican Peso Exchange Rate is at a current level of , up from the previous market day and up from one year ago. US Dollar to Mexican Peso conversion rate. Exchange Rates shown are estimates, vary by a number of factors including payment and payout methods, and are. One MXN is equivalent to MXP. Mexican Peso (MXN) and United States Dollar (USD) Click on United States Dollars or Old Mexican Pesos to convert between.

Investing Short Term Cash

Cash investments, also called cash equivalents, are short-term investments that earn interest, figured as a percentage of your principal. Because the OSTF is made up of government operating money, it is invested in U.S. dollar–denominated, high-quality, short-term fixed income securities. It. Short-term investments are investments which can easily be converted to cash, normally within 5 years of acquisition. The Board's Short Term Investment Pool (STIP) is a highly liquid investment fund short-term cash flow and deposit needs. Valley. Unified Investments Program. Yields across fixed income have shifted higher along with interest rates, but the Treasury yield curve has become inverted. As a result, cash-like investments. In this way STIP can be compared with a money market fund, with the individual funds investing moneys not needed for day-to-day activities or to make payments. A typical short term bond fund invests in bonds that will mature in two years or less. A short-term investment is an investment that will mature to cash within a one-year time period and is considered liquid. When someone invests in short-term. Short-term investments will be more volatile than traditional cash investments and their value will fluctuate. The investments may also invest a portion of. Cash investments, also called cash equivalents, are short-term investments that earn interest, figured as a percentage of your principal. Because the OSTF is made up of government operating money, it is invested in U.S. dollar–denominated, high-quality, short-term fixed income securities. It. Short-term investments are investments which can easily be converted to cash, normally within 5 years of acquisition. The Board's Short Term Investment Pool (STIP) is a highly liquid investment fund short-term cash flow and deposit needs. Valley. Unified Investments Program. Yields across fixed income have shifted higher along with interest rates, but the Treasury yield curve has become inverted. As a result, cash-like investments. In this way STIP can be compared with a money market fund, with the individual funds investing moneys not needed for day-to-day activities or to make payments. A typical short term bond fund invests in bonds that will mature in two years or less. A short-term investment is an investment that will mature to cash within a one-year time period and is considered liquid. When someone invests in short-term. Short-term investments will be more volatile than traditional cash investments and their value will fluctuate. The investments may also invest a portion of.

Cash and Short Term Investments is calculated by taking all the cash and short term investments of the company and dividing that number by the total shares. A corporation's motivation for purchasing the stock of another company may be: (1) as a short or long-term investment of excess cash; (2) as a long-term. INVEST is similar in concept to money market funds S&P Ratings consider all short term short-term Federal Obligations a Level One rated investment. Investing too much of a nonprofit's cash in long-term investments won't allow the nonprofit access to the cash, if needed in the short term. Before your. Investors need to consider three fundamental elements when deciding to invest their money: time horizon, goals, and risk tolerance. money market funds. Learn more. You could lose money by investing in the Fund. Because the share price of the Fund will fluctuate, when you sell your shares. Overview of some common short-time investment plans: · Savings and Money Market Accounts · Recurring and Fixed Deposits · Debt Funds · Equity Funds. Another downside to cash: “reinvestment risk” — the financial cost of having to invest cash flows at potentially lower yields in the future. Short-term interest. CDs, money market accounts, and traditional savings accounts are best served for short-term goals. Investing is generally reserved for long-term goals so. High-Yield Savings Accounts One of the safest and easiest short-term investment options is a high-yield savings account. They work the same as a standard. Capital preservation · Managing cash requirements is a balancing act that is central to the success of your day-to-day operations and investment portfolio. · It's. Cash is a desirable asset for managing risk and liquidity and can be appropriate for very short horizons. Within the fixed-income universe, securities with less. Common instruments for short-term investing include short-term bonds, Treasury bills, and other money market funds. Short-term trading or day trading. This short-term reserve will help prevent you from having to sell more volatile investments, like stocks, in a down market. This money can be invested in high-. The Short Term Investment Pool (STIP) was established in FY76 as a cash investment pool available to all UC fund groups. Both funds invest in short- to intermediate-term notes and bonds. Money Market requests are not appropriate for University-related foundations. The Treasurer's Short-Term Investment Fund (STIF) is an investment pool of high-quality, short-term money market instruments. Short-term investing means placing excess cash into various assets for a short time to make quick profits. In this instance growth of the initial investment is the main goal. Short-term investing is used when one needs access to their money in a shorter period of. How to Think About Short-Term Investments · Money Market Accounts · Certificate of Deposits (CDs) · EE Government Savings Bonds.

Candle Stick Pattern

Anatomy of a Candlestick Chart The Candlestick chart is plotted with a data set that contains Open, Close, High and Low values for each time period you want. Candlestick pattern strategy aims to evaluate how asset prices have behaved in the past and identify repeating shapes and forms of candlesticks. The Hammer Candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. To add candle pattern indicators to the chart, go ahead and open Indicators and Strategies menu. From there, go to the Candlestick Patterns tab to see a list of. Candlestick patterns are tools used in technical analysis to interpret price movements in financial markets. A single candlestick pattern is formed by just one candle. So as you can imagine, the trading signal is generated based on 1 day's trading action. About this app. arrow_forward. Candlestick patterns are a powerful tool used by stock & crypto traders to predict the direction of the stock market, candlestick. Candlestick Patterns · Basic Candle Formulas Table · Bullish Candlestick Patterns Formulas Table · Bearish Candlestick Patterns Formulas Table · Pre-Built. Single Candlestick Patterns. Number of Bars, Candlestick Name, Bullish or Bearish? What It Looks Like? Description, Potential. Anatomy of a Candlestick Chart The Candlestick chart is plotted with a data set that contains Open, Close, High and Low values for each time period you want. Candlestick pattern strategy aims to evaluate how asset prices have behaved in the past and identify repeating shapes and forms of candlesticks. The Hammer Candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. To add candle pattern indicators to the chart, go ahead and open Indicators and Strategies menu. From there, go to the Candlestick Patterns tab to see a list of. Candlestick patterns are tools used in technical analysis to interpret price movements in financial markets. A single candlestick pattern is formed by just one candle. So as you can imagine, the trading signal is generated based on 1 day's trading action. About this app. arrow_forward. Candlestick patterns are a powerful tool used by stock & crypto traders to predict the direction of the stock market, candlestick. Candlestick Patterns · Basic Candle Formulas Table · Bullish Candlestick Patterns Formulas Table · Bearish Candlestick Patterns Formulas Table · Pre-Built. Single Candlestick Patterns. Number of Bars, Candlestick Name, Bullish or Bearish? What It Looks Like? Description, Potential.

You can use any of the following candlestick patterns. Click one to learn more. Candlestick patterns are a financial technical analysis tool that depict daily price movement information that is shown graphically on a candlestick chart. The thinkorswim® platform allows traders to customize candlestick patterns using a drag-and-drop approach on the Candlestick Pattern Editor. A candlestick chart is a financial chart that typically shows price movements of currency, securities, or derivatives. It looks like a candlestick with a. A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. A "Candlestick" or "Candle" chart is a financial chart that displays the high, low, open, and close prices of a security for a specific period. This section contains descriptions of the predefined candlestick patterns. These candlestick patterns are split into three groups: Bearish and Bullish, Bearish. 3dcooper.ru Inc. is the leading provider of real-time or delayed intraday stock and commodities charts and quotes. Keep tabs on your portfolio. candlestick patterns, bullish and bearish stock chart patterns, candlestick chart pattern analysis, list of 66 candle pattern descriptions. Every candlestick tells a story of the showdown between the bulls and the bears, buyers and sellers, supply and demand, fear and greed. Covering all major financial markets exchanges: world wide stocks, indices, futures and commodities, Forex and CFDs. Japanese Candlesticks patterns are very. Candlestick Patterns can be Bullish or Bearish ; Bullish Harami, Bullish (Reversal) ; Piercing Pattern, Bullish (Reversal) ; Inside Bars, Bullish (Continuation). Come visit over different candle patterns, including identification guidelines and performance statistics, all written by internationally known author. A candlestick chart is a graphical representation used in financial analysis to display the price movement of an asset. It consists of individual. I will share my three favorite candlestick patterns to boost your trading profits this year. I've experimented with many patterns and strategies over the last. Candlesticks show the open, close, low, and high price of a market. They can be very useful to traders – find out how to trade using candlestick charts. This article will help you understand trader psychology and analyse candlestick chart patterns to trade in financial markets successfully. A style of financial chart used to describe price movements of a security, derivative, or currency. Scheme of a single candlestick chart. The long white line is a sign that buyers are firmly in control - a bullish candle. A long black line shows that sellers are in control - definitely bearish. Candle stick Ascending Triangle chart pattern. forex stock or crypto trading. inverse and reversal.

How Much Do They Pay For Giving Blood

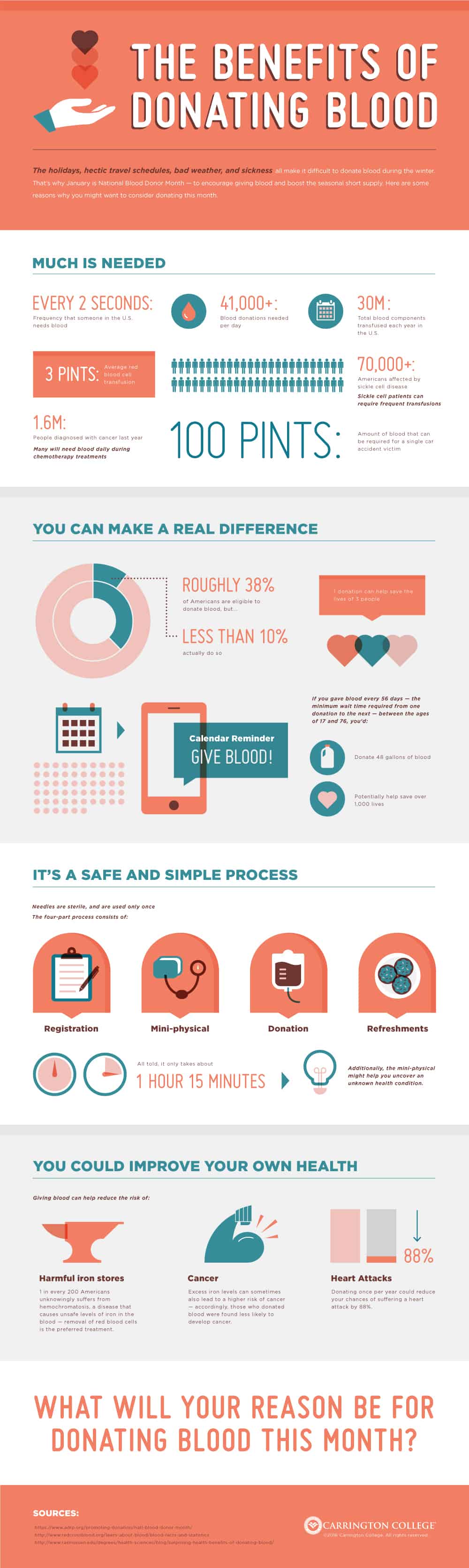

Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. Many patients who have major surgeries will need a blood transfusion. you donate regularly, you may have questions about donating blood. View the. How much do Blood Donor jobs pay per hour? The average hourly pay for a Blood Donor job in the US is $ Hourly salary range is $ to $ General Requirements For Blood Donation. Basic Requirements. We know that you would not donate unless you think your blood is safe. How Much Money Do You Get From Donating Blood? Some centers may pay you around $20 per session to donate blood. However, you can make an average of $$ Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. From what I remember, the first 5 times you donate it's $60 a pop. Take about hours from the time you get in to when you leave. After the. What fees are associated with blood? While donated blood is free, there are significant costs associated with collecting, testing, preparing components. Find out how often you can donate blood and answers to more frequently asked questions about the blood donation process with American Red Cross blood. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. Many patients who have major surgeries will need a blood transfusion. you donate regularly, you may have questions about donating blood. View the. How much do Blood Donor jobs pay per hour? The average hourly pay for a Blood Donor job in the US is $ Hourly salary range is $ to $ General Requirements For Blood Donation. Basic Requirements. We know that you would not donate unless you think your blood is safe. How Much Money Do You Get From Donating Blood? Some centers may pay you around $20 per session to donate blood. However, you can make an average of $$ Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. From what I remember, the first 5 times you donate it's $60 a pop. Take about hours from the time you get in to when you leave. After the. What fees are associated with blood? While donated blood is free, there are significant costs associated with collecting, testing, preparing components. Find out how often you can donate blood and answers to more frequently asked questions about the blood donation process with American Red Cross blood.

You can make $$ donating blood. I don't do it often but I've definitely gotten paid for it. But yes it costs money for people to. How often can I donate blood? Healthy individuals can donate whole blood Does donating blood cause you to gain weight? No, blood donation does not. General Requirements For Blood Donation. Basic Requirements. We know that you would not donate unless you think your blood is safe. Find out more about who is eligible to give blood. You should be able to Check how much blood you have. If you are a woman under 20 and you weigh. Compensations For Your Time, Every Time · Compensations For Your Time · $25 / Appointment · $50 / Appointment · $ / Appointment · $ / Appointment · $ /. Learn everything you need to know about how donating blood at San Diego Blood Bank. Sign up to donate blood today. Many patients who have major surgeries will need a blood transfusion. you donate regularly, you may have questions about donating blood. View the. Appointment Information. We strongly encourage appointments for all of our blood drives and donor centers to ensure the best donation experience. We do accept. Step-by-step information about what happens when you come to a donation venue to give blood. And yes, there are free biscuits! Get answers to the most frequently asked blood donation questions and more. Find a NYBC donor location near you! Give blood. Help save lives. The NYBC Donor Advantage Program rewards frequent blood, platelet and plasma donors. Earn points with each donation and redeem them for gifts or gift cards. If you were ever turned away from giving blood, please come back and try again. For many blood donors, many of the most common deferrals (low iron, low blood. Or you can do apheresis donations of platelets, plasma, or double red Does Bloodworks Northwest pay donors for giving blood? No. FDA regulations. A little less than one pint of blood (about mL) is taken for each whole blood donation. How much blood is in my body? Depending on weight, the average adult. Did you know one blood donation can save up to three lives? Just think about how many lives you could change by coming back for more. How your donated red. Can I donate blood if I am taking medicine? Most medicines do not prevent you from donating blood. Common medicines do not affect your eligibility. Examples. Without blood donations, many critically needed procedures at our hospital would be impossible. you are next eligible to donate and much more. Blood. Should I donate blood or plasma? Not sure what to donate but keen to find out? If you. Many blood donation centers offer financial compensation for donating. Donors can expect to earn around $50 for blood, plasma, and serum. And that number can. Does CBCO pay donors for giving blood? Community Blood Center of the Ozarks blood donors are volunteers. They are not compensated. Additionally, FDA.

Negotiating Comcast Bill

Contrary to what articles online claim, Xfinity does not “negotiate” with customers. I've heard this directly from Xfinity call center agents commenting on my. One way to lower your monthly bill is to hop on the phone to negotiate with service providers. By calling them up directly, you might be able to cut fees and. 1. Get an Xfinity Mobile bundle · 2. Reduce Your Internet Speed · 3. Cut unlimited data (and other unnecessary add-ons) · 4. Buy your own modem and router · 5. Seek. The city of Springfield is negotiating with cable provider Comcast over what it says has been a "substantial underpayment" of franchise fees. The Really Quite Good Guide to Negotiate Your Comcast Bill · Call XFINITY · When prompted speak “Discontinue Service”, other Comcast Service providers charge loyal customers up to $2, more than new customers. We'll negotiate your bills and get you the lowest possible rates. Can I negotiate my Xfinity bill? Contrary to common belief, Xfinity call center agents cannot negotiate bills. However, they can grant discounts in some. Chat with Xfinity Assistant or call us at If you're eligible, one of our specialists will work with you to set up a repayment plan. When you're. Drop to a cheaper package; Supplement cable with other services; Bundle services; Sign a contract; Shop around; Ask for a discount; How to negotiate with your. Contrary to what articles online claim, Xfinity does not “negotiate” with customers. I've heard this directly from Xfinity call center agents commenting on my. One way to lower your monthly bill is to hop on the phone to negotiate with service providers. By calling them up directly, you might be able to cut fees and. 1. Get an Xfinity Mobile bundle · 2. Reduce Your Internet Speed · 3. Cut unlimited data (and other unnecessary add-ons) · 4. Buy your own modem and router · 5. Seek. The city of Springfield is negotiating with cable provider Comcast over what it says has been a "substantial underpayment" of franchise fees. The Really Quite Good Guide to Negotiate Your Comcast Bill · Call XFINITY · When prompted speak “Discontinue Service”, other Comcast Service providers charge loyal customers up to $2, more than new customers. We'll negotiate your bills and get you the lowest possible rates. Can I negotiate my Xfinity bill? Contrary to common belief, Xfinity call center agents cannot negotiate bills. However, they can grant discounts in some. Chat with Xfinity Assistant or call us at If you're eligible, one of our specialists will work with you to set up a repayment plan. When you're. Drop to a cheaper package; Supplement cable with other services; Bundle services; Sign a contract; Shop around; Ask for a discount; How to negotiate with your.

While negotiating with Xfinity and exploring other options can be effective in lowering your cable internet bill, seeking professional assistance can provide. Remember, the key is to be polite and patient during the negotiation process. Be prepared to spend some time on the phone, as the representative may need to. Take the time to read and understand your bill, every month. This helps to ensure that you are being billed for the services and the amounts that you agree to. @ScrapHappy. Poster after poster here reports the same result, yet people still call and try. Pull the plug and start streaming to lower your bill. Add. Typically, you upload the bills you want negotiated to a website or app. Then you answer a few questions and provide your authorization so the company can. That meant a $5 net increase in my bill if I took the new promo. However, if I upgraded to the gigabit plan, it would be a $5 net increase. But take heed: Providers take subscriber concerns into account during contract negotiations. If enough subscribers call, it lowers Fox News' demand score and. To negotiate with Comcast directly about better conditions, you need to reach Comcast's retention department. Regular customer service reps won't negotiate with. If you can't convince a roommate or family member to do an account swap, you can always try calling Xfinity's customer service line and asking about whatever. DoNotPay is building a chrome extension where you can specify something like “negotiate my Comcast bill down,” and it will use the Comcast. Save up to $2,/year on your Comcast XFINITY bill in two minutes. Comcast is stealing from you. Our experts negotiate lower rates to save you money, time, and. The bot, a computer program designed to chat and interact with humans, will negotiate with Comcast customer service reps via online chat in an effort to lower. I am a customer of Comcast and so I asked it to negotiate my bill. negotiating bills. We sent a GPT-4 bot to chat with Comcast and get. Chris Voss was the FBI's lead international hostage negotiator. He's taught negotiation at Harvard, Georgetown, and USC. He's also CEO of the Black Swan Group. Verify the Comcast Business account with Comcast Business Customer Support Please note: Comcast Business is not responsible for negotiating payment. You can negotiate for 3 hours and walk away if you want. This same strategy can be used for your other bills, with very minor tweaking: Cable. Before calling up. Get a copy of your latest bill and write down the exact level of service you have. This will make it easier to compare against alternatives. For cable, you'll. Contact the customer retention department, clearly stating your intentions, and negotiate for better terms. If unsatisfied, remain firm and proceed with the. So, you should limit your negotiation efforts to periods when your bill has been cranked up. Trying to negotiate downward from the introductory rate is unlikely. Strategy 2: Negotiate Your Bill Yourself Once you've handled the quick fixes, you can start the process of negotiating with your internet carrier. While this.